Well, the Dow Jones Industrial Average index tried to close in the green today, but failed. The next few weeks — and even months — may get ugg-ly for investors.

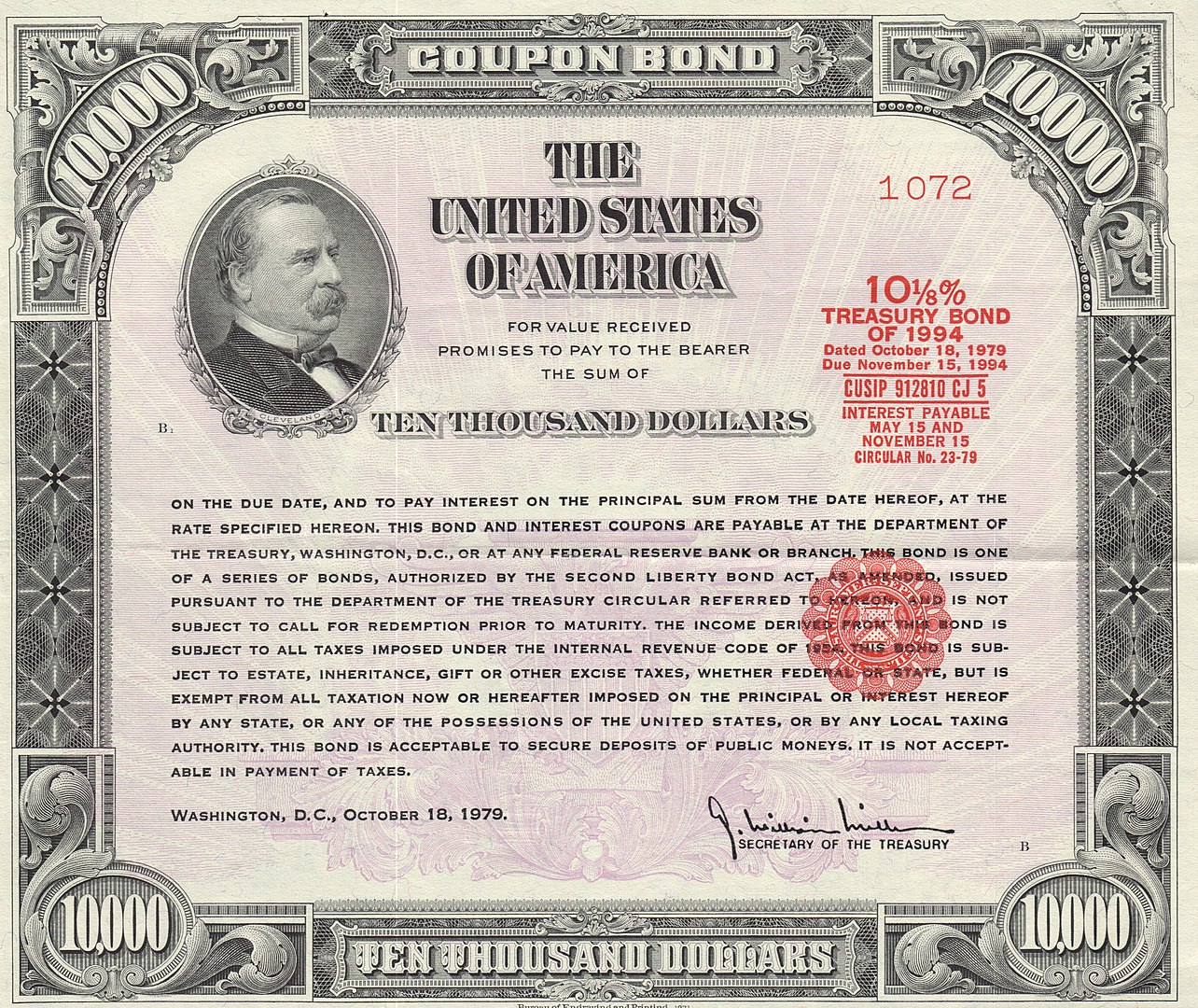

The 10-Year US Treasury Bond’s rate closed at an all-time low today: 1.310 %. So: many investors are putting their money into these bonds to seek safety from the stock market sell-off, driving the rates down.

Update Fri 2/28: When all had been said and done at the end of a tumultuous week, the 10-Year had closed down even lower, at 1.13 %. So going to 1.00 % is certainly possible.

Update Tue 3/3: And there it was. The 10-year US Treasury note yield ended the day at 1.005%, after falling to an intraday record low of 0.914%. Earlier in the day, the Federal Reserve Bank surprised everyone with a 0.50% emergency rate cut to the federal funds rate (now down to 1.00-1.25%, from 1.50-1.75%).