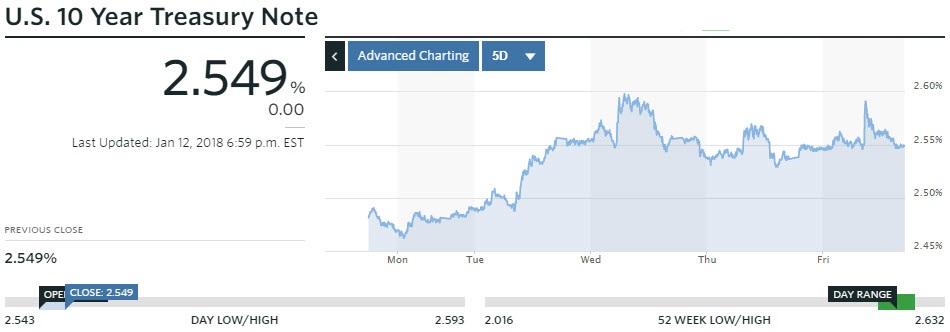

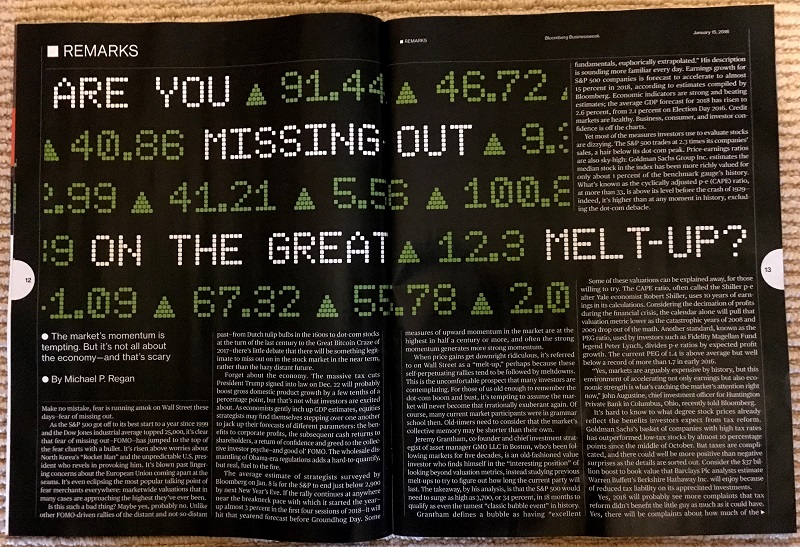

It’s not even mid-January, and the stock market is already up 4% for the year.

Veteran investor Bill Miller said on CNBC this week of the US stock market, that there might be a ‘melt-up’ this year. Bond investors could soon decide that they are missing out, and start pouring lots of money into equity funds. This scenario could add another 30% of valuation – this to a stock market that has now gone up for nine years, with no 10% (or more) correction since 2011. Whoah. That would be a time for even the most optimistic investor to start to panic.