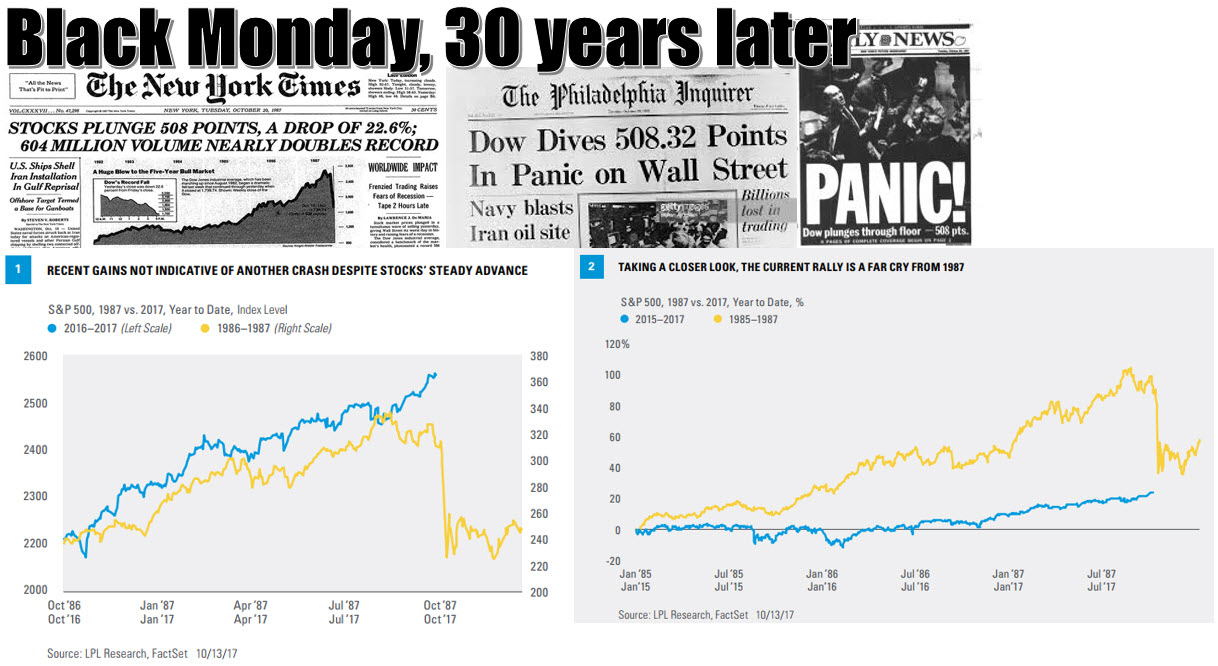

Thursday marked the anniversary of the US Stock Market crash of 1987, called Black Monday. The Dow Jones Index fell by 22.6% in one day, a record decline that stands to this day. The impact was felt worldwide. ‘It is a sobering experience’ said my dad at the time. In South Africa, the Johannesburg Stock Exchange Index would slump by 38% in the month that followed.

Under current rules, if the broader S&P 500 index falls more than 7.0% before 3:25 p.m. New York time, trading is paused for 15 minutes. If the decline continues once trading resumes, and it is still before 3:25 p.m., the market is again paused at 13% down. If the decline happens after 3:25 p.m, trading continues. But if the decline reaches 20%, trading is suspended for the session, regardless of the time of day. Still, said the traders on the floor of the New York Stock Exchange today: the forces in the market driven by fear are very powerful, and even the circuit breakers may not prevent the market from going down significantly in a very short time.