“It’s incredible. Did you ever think in our lifetime we’d see a $5 trillion company?”

– David Faber, a host on the CNBC show “Squawk on the Street”, this morning

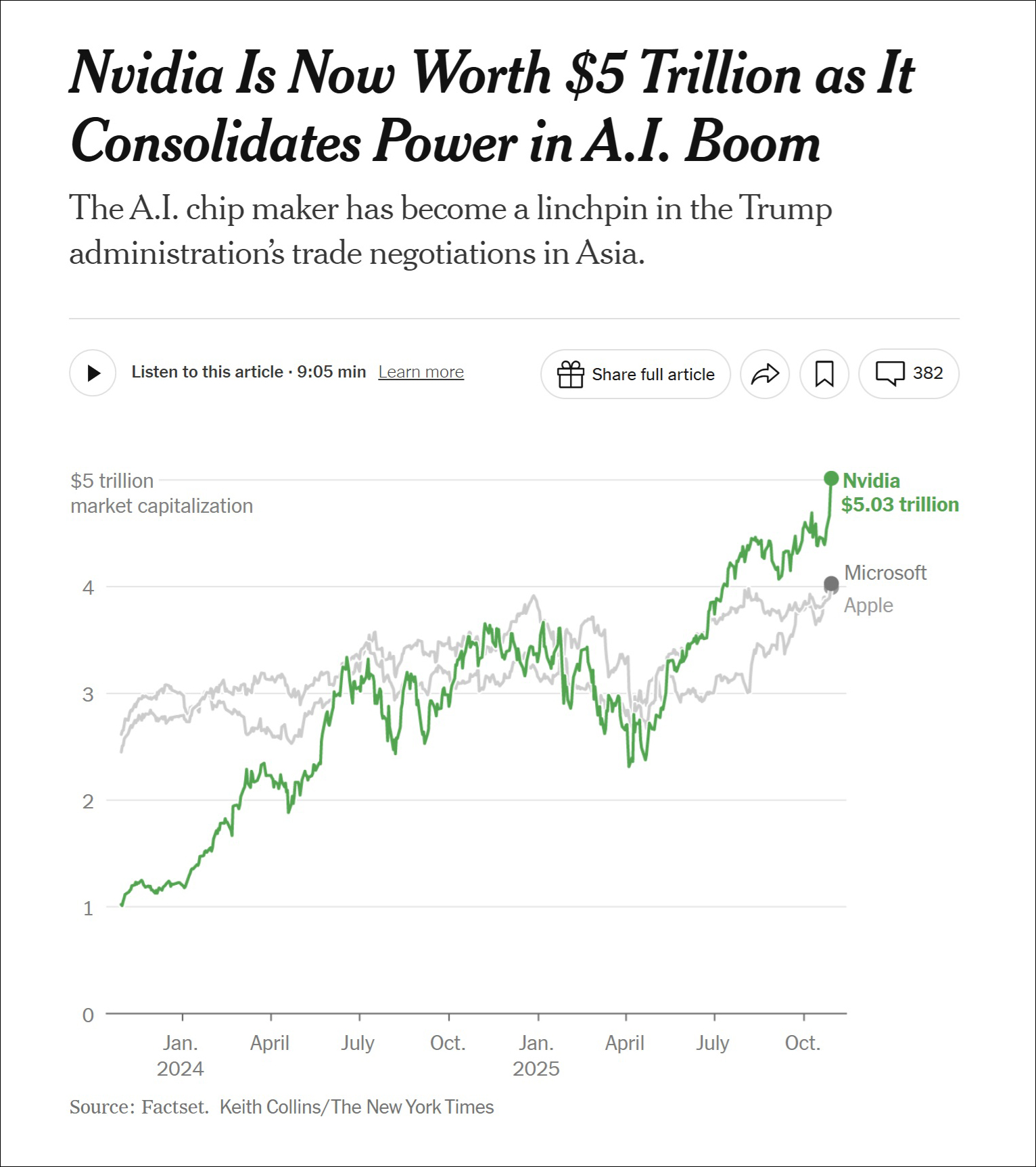

Artificial intelligence chipmaker Nvidia (ticker symbol: NVDA) is now worth 5 trillion US dollars.

The company’s latest AI superchip (the Blackwell Ultra) carry 200 billion transistors. Nine out of ten AI chips that are sold in the world, are made by Nvidia.

Tripp Mickle, writing for the New York Times:

Nvidia’s milestone, making it the first publicly traded company to top $5 trillion in market value, is indicative not only of the astonishing levels of wealth consolidating among a handful of Silicon Valley companies but also the strategic importance of this company, which added $1 trillion in market value in just the past four months.

Meanwhile, President Trump indicated that he would discuss the sale of Nvidia’s Blackwell chips with China in the summit on Thursday. Some US officials say that would be “massive” national security mistake.

So there is the answer to the question as to why the stock market indexes keep going up while the economy is barely growing. It’s the tech companies that are pulling them up.

Jason Furman, a professor of economic policy at Harvard, calculates that spending on data center construction accounted for 92% of the GDP growth in the US in the first half of the year. Take all of that out, and the US economy would have grown at a measly 0.1%.

[Graphic and headlines from the New York Times]