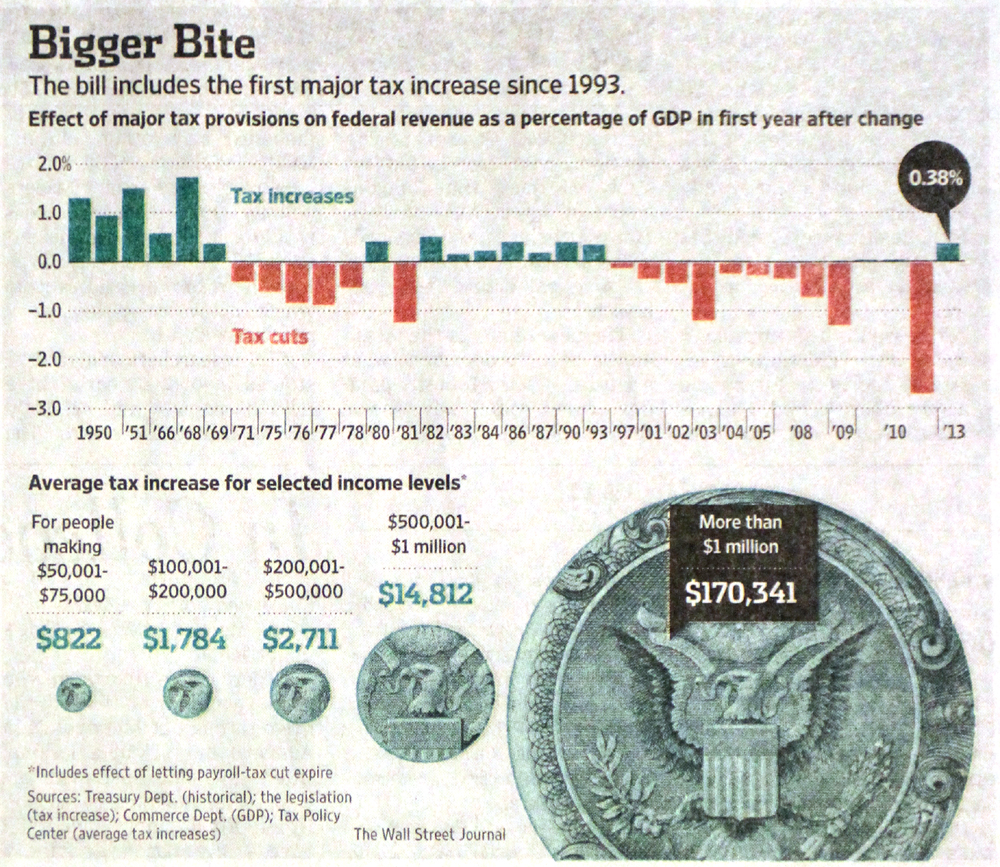

I got home in time Tue night to see the US House of Representatives vote on the Fiscal Cliff legislation. As the graphic from the Wall Street Journal shows, there just had to be an increase in taxes after all the cuts since 1993. Federal income tax rates will only go up for individuals with income over $400,000 (!) and families earning more than $450,000 .. but since the temporary 2% cut (for 2011 and 2012) in Social Security taxes was not extended, taxes go ‘up’ for almost everyone, anyway. Next up: another Debt Ceiling fight – even though Pres. Obama says there will not be one? And the estimated $600 billion of additional tax revenue (over the next 10 years) from the Fiscal Cliff legislation is still not nearly enough to address the annual deficits in the US government’s budget. After the deficit had exceeded $1 trillion for each of the last four years (total debt now at $16 trillion), it could possibly drop below that in 2013.

a weblog of whereabouts & interests, since 2010